Why Hard Tech Portfolios Should Be Concentrated

Breaking VC Dogma

Traditional venture advice says to build large, diversified portfolios. Place lots of bets and ride the power law. But Hard Tech companies aren’t lottery tickets, they’re path-dependent engineering programs. The major risk isn't "will the market want this?", it’s "can you hire the 10 people on Earth who can build this?" Talent is a gating variable, not just capital. And once the right team is assembled, the execution advantage compounds fast.

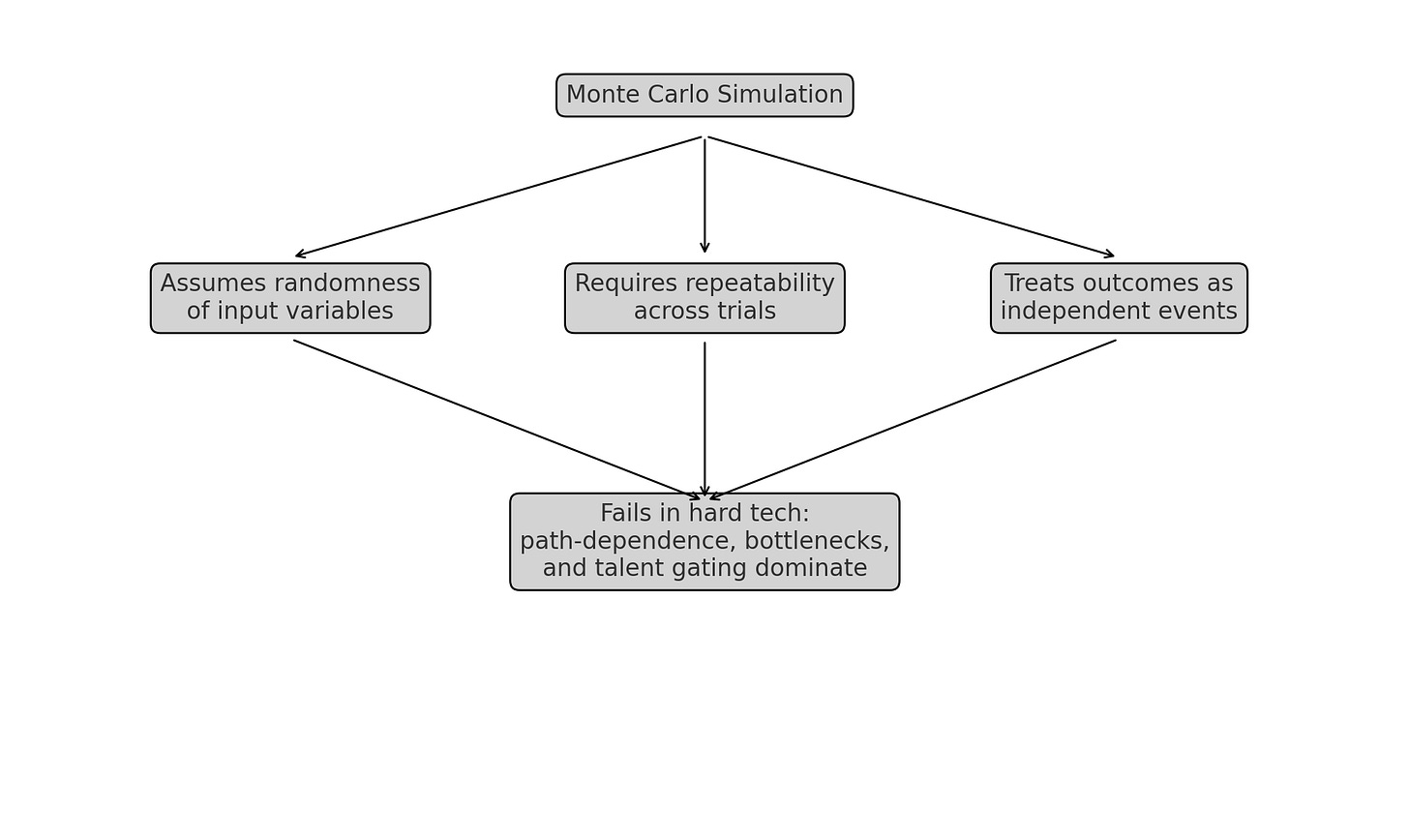

What’s fascinating to us is how this insight is obvious to operators and builders in the space, but takes a bit for newer investors in the space to grok. Standard portfolio construction logic, especially Monte Carlo-style simulations, miss the mark. Those models assume independence and randomness, but in Hard Tech, outcomes are path-dependent and bottlenecked by talent aggregation.

So the job of a hard tech investor isn’t to diversify, it’s to concentrate. Find the few teams in the world with the credibility, skill, and speed to win, and go deep with them.

Quick addendum: There is a version of Hard Tech investing that works with broader portfolios. If the fund’s strategy is to co-invest alongside top signal-generating GPs in the category, then access, network, and being easy to work with are the alpha.