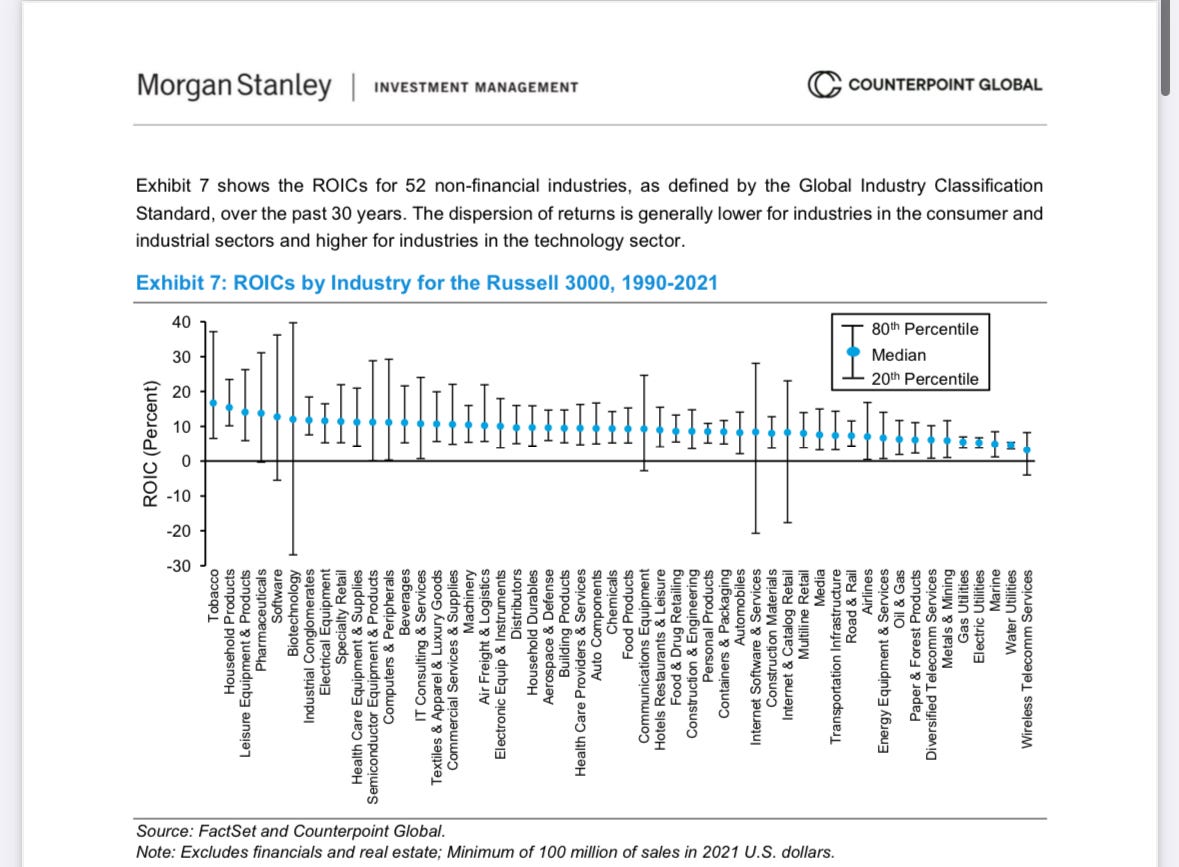

Venture Returns and ROICs

Why dispersion is a leading indicator of outlier potential

I went a bit down the rabbit hole this weekend to look at Return on Invested Capital (“ROIC”) metrics by sector.

In short, the greater the dispersion of ROICs, the greater potential for outlier venture returns.

There are obvious high dispersion ROIC“Traditional VC” sectors like:

- Software

- Internet Software & Services

Or “Life Sciences VC”:

- Pharma

- Biotech

Or “Consumer VC” sectors like:

- Internet & Catalog Retail

- Leisure Equipment & Products

But there’s less obvious ones like:

- Semiconductor Equipment

- Computers & Peripherals

- Communications Equipment

It’s this last group where the biggest opportunity in “Hard Tech VC” really exists.

Ultimately, the job to be done in venture is to capitalize and help support the development of businesses with high ROIC potential, regardless of sector. I wrote about this in more depth here.

(Chart source: https://www.morganstanley.com/im/publication/insights/articles/article_returnoninvestedcapital.pdf)