Take More Risk

Why we underestimate our ability to take financial risks

One of my favorite blog pieces from back in my CFA studying days was “Human Capital and Your Portfolio”. TL;DR - People underweight the value of their (relatively) stable incomes, and end up underweight risk in their financial portfolios.

Here’s the technical definition the piece gives to human capital:

“Human capital is commonly defined as the present value of your projected labor income for your working years. See, for example, Lifetime Financial Advice: Human Capital, Asset Allocation, and Insurance. In other words, it’s a measure of your future earning power. Over the course of your career, you essentially convert human capital to financial capital by saving and investing a portion of your employment income.”

The piece also goes on articulate certain job types into more “equity-like” or “bond-like.”

“In short, a risky job is more “equity-like”; a safe job more closely resembles a risk-free bond. For instance, if your income varies from year to year — say, because you have a bonus- or commission-based job — or it’s highly correlated with the stock market, then we can say that your human capital is “stock-like.””

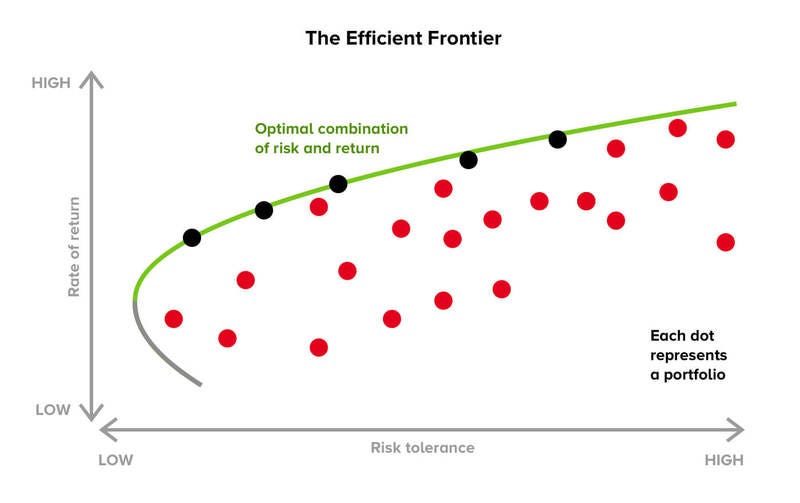

What does this mean for the average investor? My (biased) view…they should be investing in much more risky assets, especially when their time horizons are long. This framework is one of the main drivers of why I started angel investing at 27 (aside from the fun that comes from investing in and supporting my smartest friends). Starting earlier is important…the benefit of this kind of risky investing can take a long time to compound!

So don’t be afraid to start taking more risk, whether that’s by taking your “bond-like” job and making it more “equity-like”, or just by selling some of those IBM bonds and buying Tesla call options. If done right, it can have massive non-linear payoffs and, most importantly, can be a lot of fun along the way.