RaaS, HaaS, SaaS...

...and the importance of pricing power on the "as a service" business model.

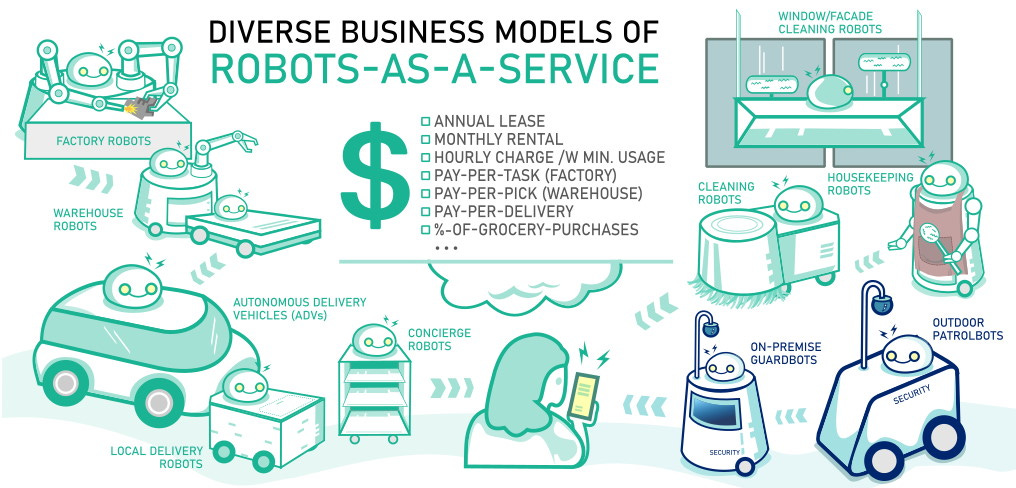

Over the last ~20 years, we’ve seen “X as a service” business models explode. Software (“SaaS”), obviously, is the most prominent, but it’s cropped up in other sectors like Robotics (“RaaS”), Hardware (“HaaS”), and Infrastructure (“IaaS”).

Investors love this for two reasons: (1) by providing something “as a service”, it can be packaged and sold as high gross margin and recurring revenue, and (2) it’s (in theory) “capital efficient” because one doesn’t need to carry lots of inventory to sell that product on a single unit basis. Both of these should result in higher valuation multiples than a similar business that doesn’t operate on the “as a service” model.

This model works when debt and equity are cheap. I can borrow or raise cheap equity capital on a long time horizon, limit my working capital needs by reducing inventory spend, and be valued on an LTV/CAC basis. Everybody wins! That is, until rates start to rise.

Given that we’re effectively financing the “as a service” revenue with debt and/or equity, then our return on capital (Net Income / Total Capital) needs to exceed our total cost of capital, otherwise we’re destroying equity value. It should also logically follow that as cost of capital rises, LTV/CAC for “as a service” models also needs to rise to offset that. Most SaaS businesses can achieve this because they have pricing power. This is well documented, with SaaS pricing inflation growing 4x faster than market inflation. But what about businesses with less or no pricing power?

Take the example of a RaaS business selling robotics to auto OEMs. Auto OEMs operate in a highly competitive, low margin industry. They underwrite long-term capital expenditures on the basis of long-term forecasts of gross margin, inventory turnover, and cost of capital. How open would they be to annual price increases on their robotic automation that exceed market inflation by 400%? That is a direct hit to the bottom line and, ultimately, their stock price. Likely not very open…

We see this a lot in the businesses we look at. Founders (and often other investors) say the company provides something (often hardware or robotics) “as a service” so they have “ARR” and should be valued on a revenue multiple commensurate with the heuristics often used to value SaaS businesses. Over the past 20 years this wasn’t an issue. One could get away with it as falling rates lifted all boats. But with rates rising / higher, I think we’re about to see a reckoning in these “as a service” businesses in the years to come, with growth slowing, margins compressing, and difficulty raising capital and financing their operations in ways that create real equity value.

The right path forward, as we see it, is to vertically integrate and compete. Great technology at scale should provide cost or quality advantages selling into end markets that result in monopoly power or cost leadership. These are the businesses we’re looking for. They’re hard, require ambition, and often lots of capital, but this is the way that you get the SpaceX’s, Andurils, and Varda’s of the world.

It’s also a lot more fun :)

Great read!