How to Make Better Decisions

Why trusting your gut is the path to outperform, and the role of data in the decision-making process

The best people I’ve worked with have an intuitive sense of the right decision to make at any given time. This intuitive sense is especially important when building ambitious, (often) first of a kind things of consequence. One might simply call this having good judgement, or probabilistic thinking. Sometimes we might be right, sometimes we might be wrong, but in the long run these people are right more often than they’re wrong and tend to win and build things of consequence as a result.

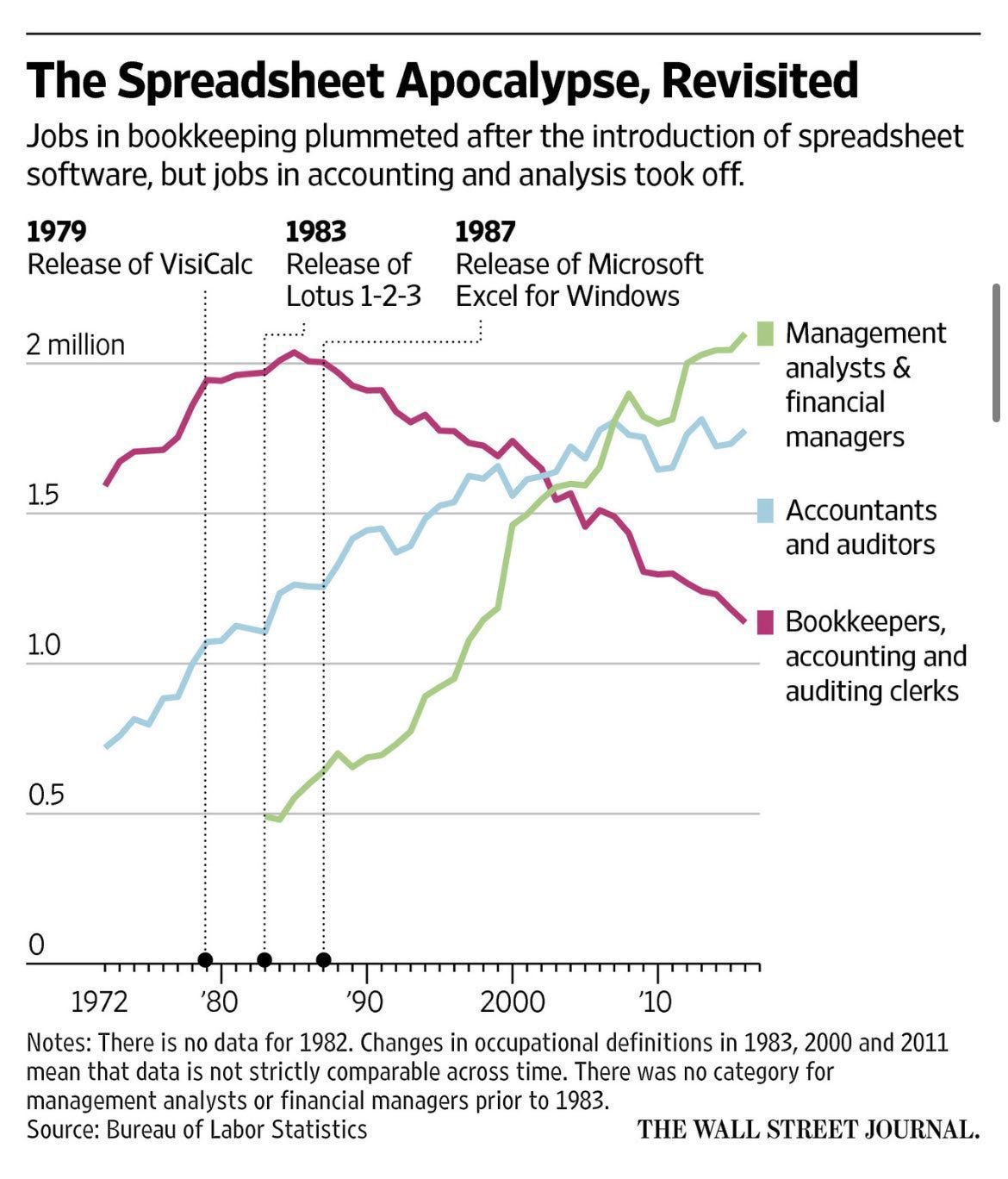

With the explosion of data and analytical decision-making tools over the past 50 years, it’s no surprise that leaders who think and make decisions in this manner are in increasingly scarce supply. Look no further than the explosion of “management analysts” and “financial managers” since the release of Visicalc in 1979. There’s comfort in this as people can point to the (now abundant) data and say “see, the data supports this decision” in attempt to absolve themselves of responsibility for a future outcome.

But without individual accountability for outcomes, it’s near impossible to achieve anything great. Said differently, there’s no alpha in comfort.

If one wants to outperform, you need to have a different way of analyzing and evaluating the world that is data-informed, but people-driven.

In my experience, leaders that do this effectively exhibit three key attributes:

They’re extremely close to the problem they’re solving. They understand it inside and out. They can speak in nuance about every element of the problem, and the pros and cons of each contemplated (current and historic) solution.

They know how to read people around them and use that to inform their judgement. They don’t need to see the test data, they collect data points from the actions and reactions of the people closest to that test data. Call it meta data.

They think long term. They desperately try to avoid being forced into short-term decision-making. Their decision-making game theory focuses on long-term incentives and outcomes. It’s incredibly hard to predict short-term outcomes, but on a long enough time horizon and with the right information, we can dramatically increase the accuracy of our predictions (i.e. it’s way easier to predict the 10-year return on the S&P 500 vs. what the return will be next month).

Data is great, but details, people, and long-term thinking matter most.