Credit Markets and Hard Tech

Short term pain, long term gain

Hard tech companies can take a long time to achieve their full potential. They also often require significant capital investment (in tangible and intangible assets) to get there. Given this, the most important thing for a sustainable Hard Tech movement is consistent, and growing, capital availability.

What drives this? It’s not short term stock movements. Instead, look at medium and long term credit markets (“rates”). If long term rates are low to moderate, we incentivize long term investment. If long term rates are high, we incentivize savings over investment. High rates disincentivize long term investment in things like manufacturing, supply chains, and workforce training and development. If an institutional investor can earn 7% while holding 10Y Treasuries, why would they lend to an industrial manufacturing company at 8%? If that same 10Y rate comes down, that 8% will look a lot more attractive, and the manufacturing business will get the loan they need to expand capacity!

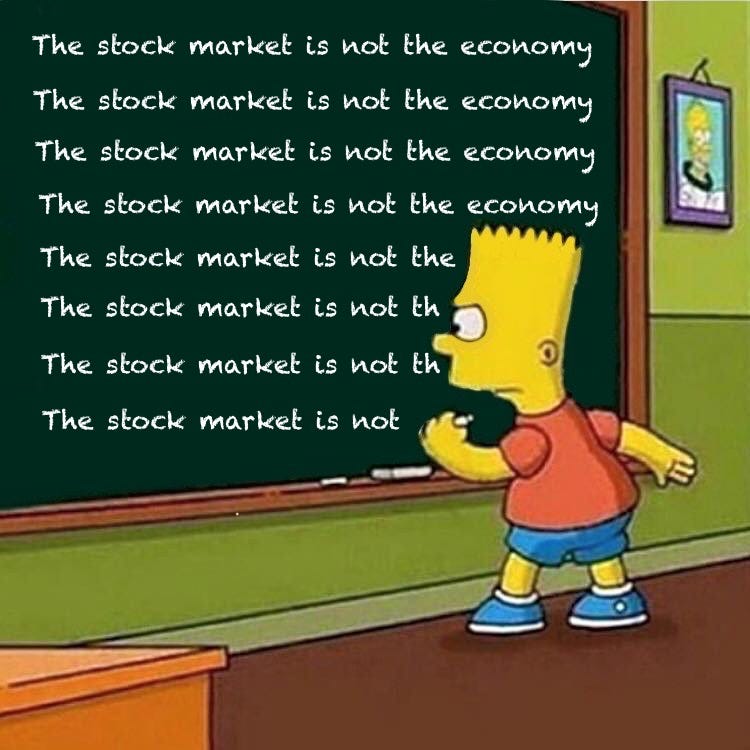

With stock markets flashing red the last few weeks, it’s easy to lose sight that medium and long-run prosperity is what matters over short term asset prices. The last 20 years have been among the best returning periods for US equities. If we want that to persist for the next 100 years while simultaneously transitioning to a stronger real economy for more Americans, some short term stock market losses are a small price to pay.